PACARES

PROVIDING RELIEF FOR WORKING PEOPLE IN A TIME OF CRISIS

PA CARES 21 Plan

Pledge your support today

Thousands of Pennsylvanians have been negatively affected by the COVID-19 pandemic and are struggling, through no fault of their own. About $2.6 million in federal coronavirus aid, intended to help spur recovery across the U.S., was directed to critical areas in May. However, the Republican-controlled legislature chose to direct the remaining $1.3 billion in recovery funding to help fill Pennsylvania’s budget deficits. That decision has left thousands of Pennsylvanians without a lifeline as the pandemic continues and cases are on the rise. Sign the petition for the Pennsylvania CARES 21 plan proposed by the Pennsylvania Senate Democrats. The $4 billion plan would direct money to programs and areas of need that would help working individuals and families, small businesses, front-line workers, and more.

Add your name to the petition and pledge to call your legislators and demand their support for the PA CARES 21 Plan.

Sign our Petition

Supporters & counting

Pennsylvania Coronavirus Aid, Relief & Economic Security Act of 2021

“PA CARES 21”

A State-Funded Stimulus Plan to Respond to the Coronavirus Pandemic

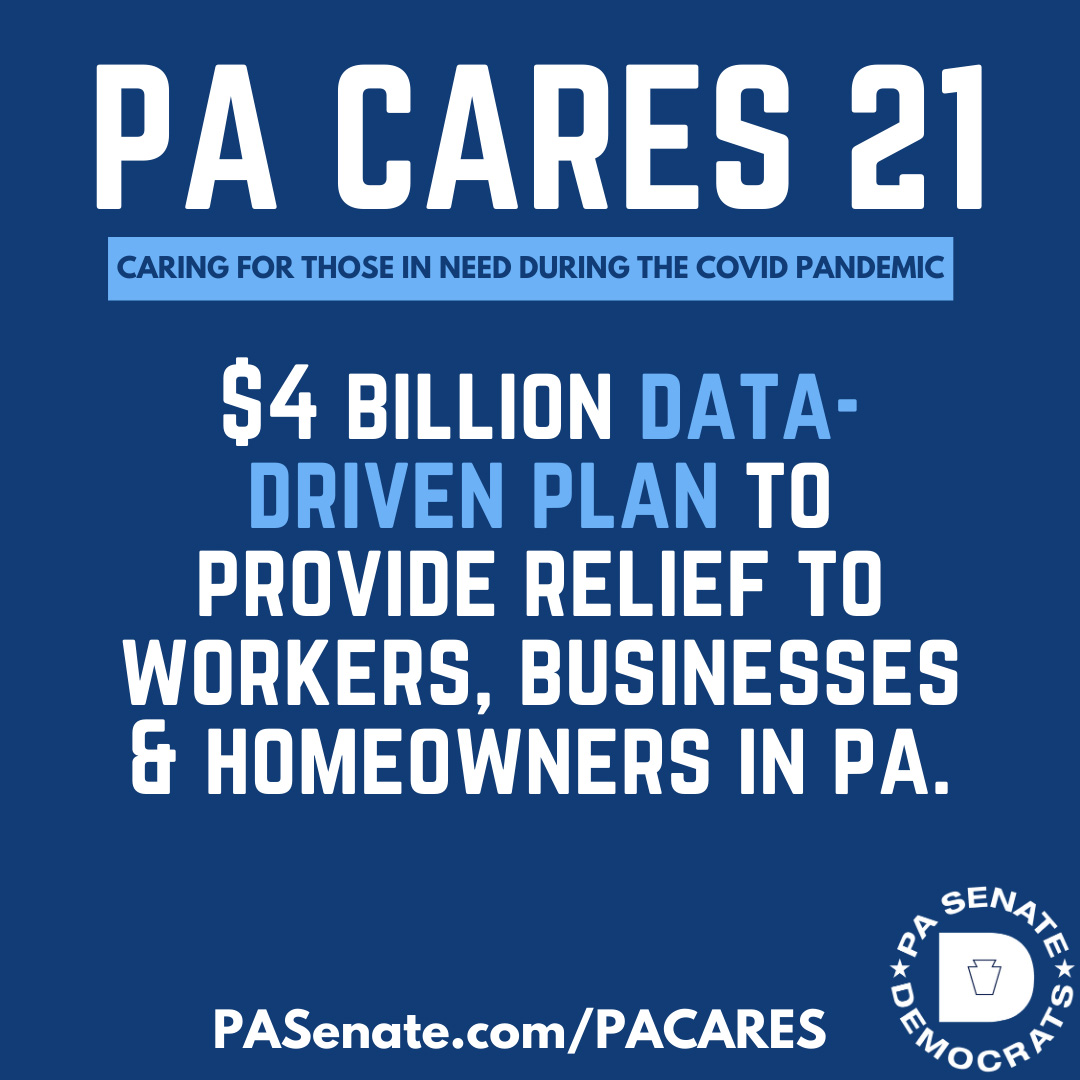

Aiming to stimulate Pennsylvania’s economy by providing direct aid to workers, families, small businesses and other vulnerable populations, the Pennsylvania Senate Democratic Caucus announced a bold, innovative $4 billion pandemic relief plan Friday morning.

The Pennsylvania Coronavirus Aid, Relief & Economic Security Act of 2021 (PA CARES 21) Plan would fund previously existing aid programs and establish new programs to help struggling Pennsylvanians and struggling areas of the commonwealth’s economy.

“Folks have not seen pandemic-specific relief from the state or federal government since last spring, yet thousands remain unemployed, underemployed and struggle with their housing and utility bills. This cannot go on any longer,” said Senate Democratic Leader Jay Costa. “There are immediate needs in communities across this state that must be addressed immediately. We are in the middle of another surge in COVID cases, hospitalizations and deaths. We need help to recover, personally and financially; the state must play an active role in that recovery and that is what our plan today does.”

Highlights

Frequently Asked Questions

What are we announcing?

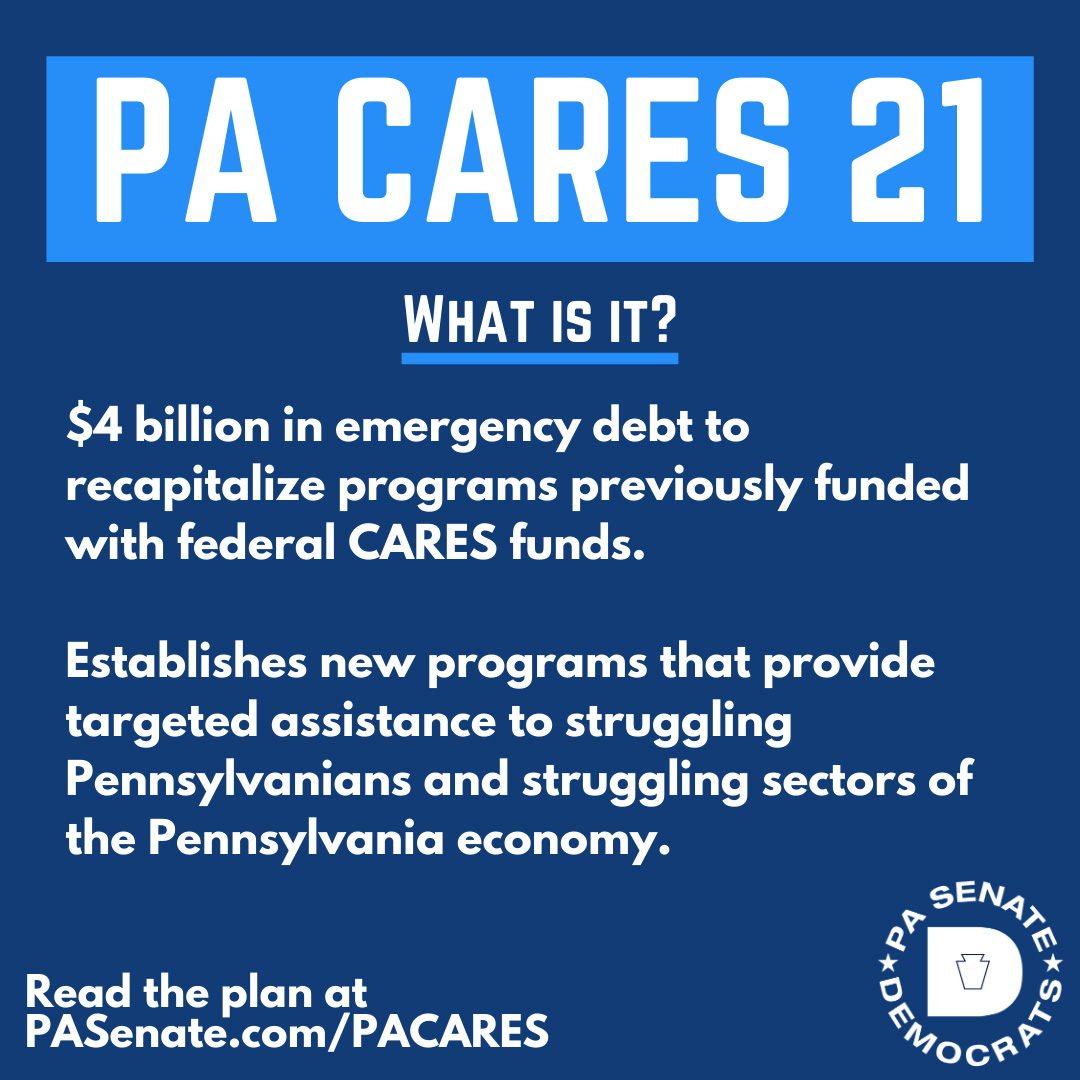

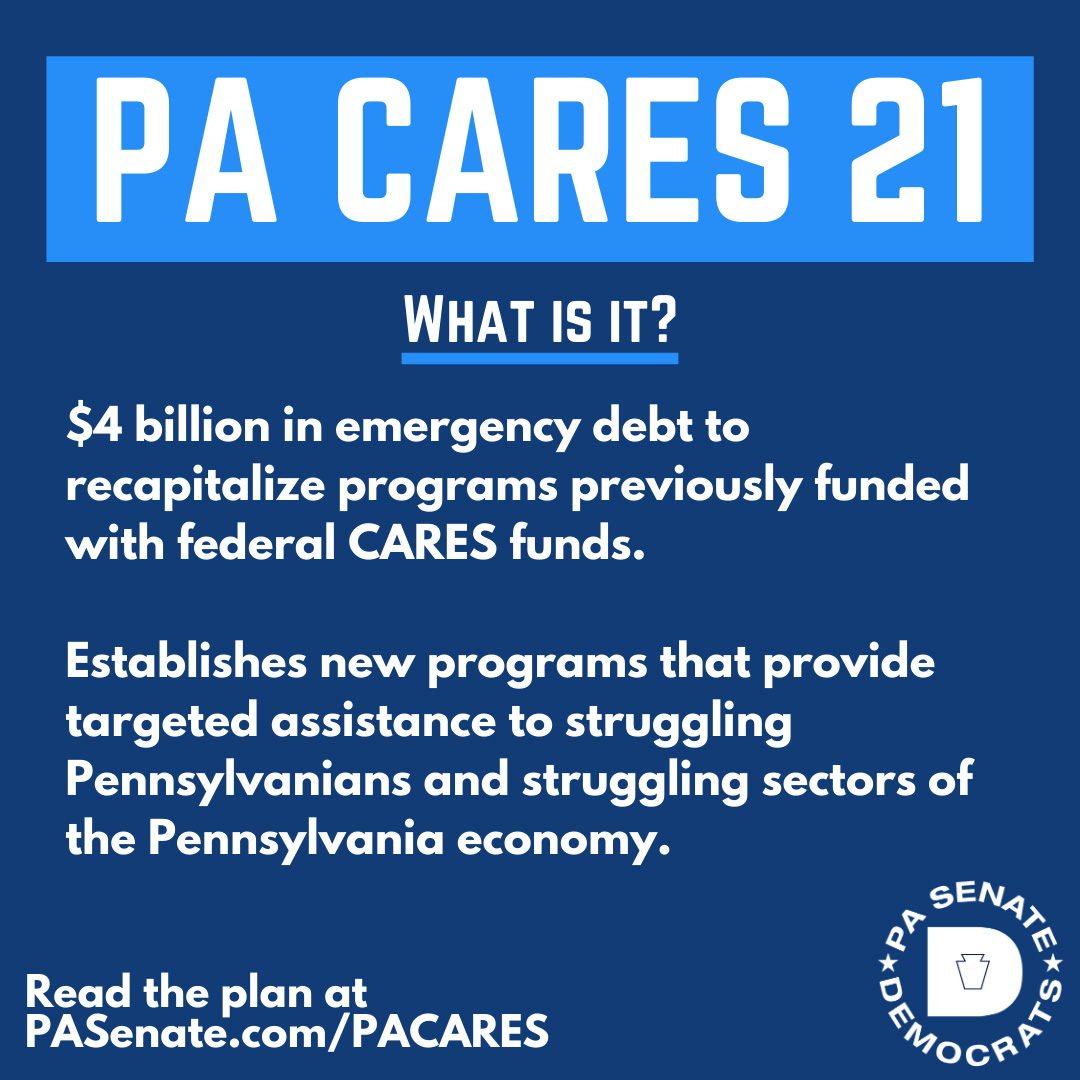

PA CARES 21 authorizes the commonwealth to issue $4 billion in emergency debt to (1) recapitalize programs previously funded with federal CARES funds pursuant to Acts 2A, 24 and 30 of 2020 and (2) establish new programs that provide targeted assistance to struggling Pennsylvanians and struggling sectors of the Pennsylvania economy.

Why are we announcing this proposal now?

Time is of the essence. COVID-19 is surging in Pennsylvania with cases rising daily. People continue to get sick, workers continue to lose their jobs, businesses continue to close, and our educational system continues to be disrupted. Pennsylvania and Pennsylvanians are suffering and need support now.

The 2021-2022 legislative session does not officially begin until January 5, 2021. How do you reconcile that fact with your belief that “time is of the essence.”

Wouldn’t a new federal stimulus package be preferable to a state-solution?

The recently enacted FY 2020-21 General Fund Budget was balanced in part by using $1.3B in federal CARES funds despite the fact those funds were intended to be used to help Pennsylvanians mitigate the impact of the pandemic. Was that decisions wrong? If so, why did some Senate Democrats support it?

What if the federal government reaches agreement on a new federal plan in the next few weeks? Do you believe this plan is still necessary?

Q: Do you think the Republican-controlled General Assembly will entertain a $4 billion bond issue considering their historic aversion to borrowing?

Besides the federal government, the Commonwealth of Pennsylvania is the only entity that has the capacity to provide substantial resources to help our citizens. One of the core functions of government is to protect the health, safety and welfare of its citizens. If we can’t come together at this moment in the face of this unprecedented crisis and harness the power of state government to provide the financial relief that our citizens are desperately crying out for, then we have failed not only ourselves but those who we were sent to Harrisburg to represent.

How much does your proposal spend? What areas do you focus on?

Unemployment Compensation Protection $1.069 billion

Business Assistance $800 million

Local Government Assistance $595 million

Education (Pre-K thru Higher Ed) $411 million

DHS Programs $318.4 million

Transportation $180.4 million

Hazard Pay $135 million

Hospital Assistance $100 million

Housing Assistance $100 million

Utility Assistance $100 million

Child Care $75 million

Food Security $50 million

Public Safety $25 million

PPE/Vaccine Issues $25 million

Mental Health Programs $15 million

What is included under each of your categories?

Unemployment Compensation Protection: Covers 509,000 individuals currently collecting federal PEUC and PUA benefits that are set to expire on December 26 unless extended by Congress. Claimants would receive $350/wk. for six weeks.

Business Assistance: Targeted funding for bars/restaurants/hospitality industry; additional funding for the current DCED/CDFI program for Main St. and Historically Disadvantaged Businesses; targeted funding for barbers/salons/personal care businesses, nonprofit organizations, and tourism/arts and culture organizations.

Local Government Assistance: Funds for counties and municipalities that have seen reduced local revenues due to the pandemic.

Education: Additional funding to address the needs of the Pre-k thru 12 and Higher Education system.

DHS Programs: A second round of funding for certain DHS programs funded in Act 2A of 2020. Funding would be at 40% of the Act 2A amount.

Transportation Systems: New funding for mass transit and commonwealth airports based on a percentage of that received from the federal government under the CARES Act.

Hazard Pay: Additional funding for hazard pay for frontline workers. Over 100,000 frontline workers could benefit.

Hospital Assistance: Funding for hospitals that serve our Medicaid population.

Housing: New funds for housing and rental assistance Utility Assistance: Funds to help individuals in arrears on utility payments

Child Care: Additional funding for child-care providers to continue operating.

Food Security: Additional funding for food banks, anti-hunger programs, and the agriculture industry.

Public Safety: Additional funding for EMS and Volunteer Fire Companies that have been impacted by the pandemic.

PPE/Vaccine Issues: Funds to create a commonwealth PPE stockpile and to cover costs associated with uninsured individuals receiving the vaccine.

Mental Health Programs: Funding to ensure adequate programs exist to address the mental health impacts the pandemic is having on Pennsylvanians.

How did you determine priorities for funding?

Pennsylvanians continue to bear the brunt of the pandemic. With federal CARES funds, we focused on getting money into people’s pockets, protecting our health care system and frontline workers, ensuring the viability of our education system, and assisting our small businesses. We continue that commitment with PA CARES 21, while expanding to areas that have shown a real need for assistance.

Will you use existing programs or create new programs to drive out the funds?

Where appropriate, this proposal utilizes the programs created under Act 24 of 2020 to drive out the funds. If proposed funding does not fit into an existing program (e.g., utility assistance), a new program will be created.

Additionally, we support fixing programs created by Act 24 (e.g., PHFA’s rental assistance program) as requested by stakeholders to maximize program effectiveness.

What form will the financial assistance take?

The funds will be allocated as grants to entities that are providing the goods and services we need. Funds will not need to be repaid.

Are there restrictions on the use of these funds like the federal CARES Act.

PA CARES 21 funds are designed to be flexible. However, they must be used for costs incurred due to the COVID-19 pandemic. Unlike federal CARES funds, counties and municipalities may use these funds to replace local revenue lost due to the pandemic.

What are the specifics of the bond issue?

Amount: $4,000,000,000

Issuer: Commonwealth Financing Authority

Proposed Term: 25 years

Estimated Debt Service: $190,000,000/yr.

How did you settle on $4 billion?

This is the approximate amount the commonwealth received under the federal CARES Act. We wanted to match that amount to provide substantial relief to Pennsylvanians.

How will debt service be paid?

Annual debt service can be paid from any of the following sources:

- Liquor Control Board revenues

- Gaming revenues

- Dedication of Personal Income Tax or Sales Tax revenues

- The recently enacted budget included a one-time transfer of $200M in PIT revenue to the Property Tax Relief Fund. Beginning next year, that same amount can easily be shifted to debt service payments for this program

Does the bond issuance require voter approval via referendum?

No. We do not believe a referendum is required based on the purpose and structure of the proposed bond issue.

Round 2 • October 16

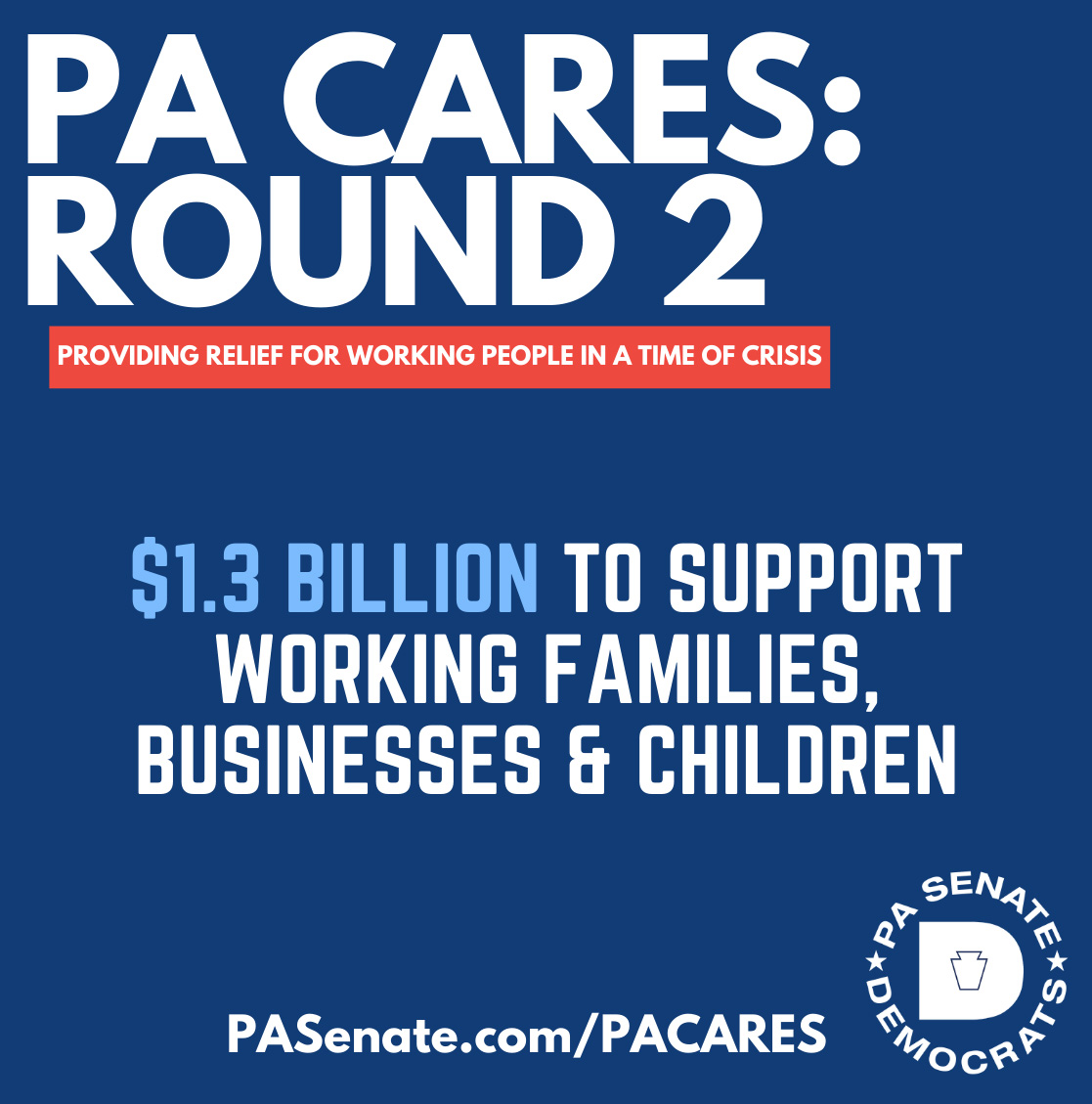

Senate Democrats outlined the caucus priorities for spending the remaining $1.3 billion of Pennsylvania’s federal CARES funding. This announcement follows the release of our original PA CARES plan in April of this year. That plan was largely included in the first round of funding passed by the General Assembly and signed by Governor Wolf in May. The money must be spent by December 31st on COVID-19 related needs or the state loses the authority to use it at all.

Highlights

Frequently Asked Questions

What are we announcing?

Why wasn’t all the money spent in May?

In May, the Senate, House of Representatives, and Governor Wolf worked together to drive out more $2.6 billion in federal CARES funds to help Pennsylvanians deal with the impacts of the coronavirus.

Acting quickly, we provided a lifeline to families, small businesses, counties, and others struggling through the pandemic. Our work reflected the best of bipartisanship as we came together to produce results for Pennsylvanians.

At that time, we also made the collective decision to retain some of the CARES funds (approximately $1.3 billion) to address unanticipated costs that could arise through the summer and fall. This was the right decision in May. However, circumstances have changed.

: Why now? What circumstances have changed to prompt this announcement?

First, Pennsylvanians can’t wait any longer for the financial assistance provided through the CARES Act. People continue to suffer. Businesses continue to close. Pennsylvania’s COVID case numbers are rising again. The end of the pandemic is nowhere in sight. We need to act now.

Second, the Trump Administration and Mitch McConnell have failed Pennsylvania and Pennsylvanians. Today marks 155 days since House Democrats passed the HEROES Act, which provides close to $1 trillion to assist state and local governments. Trump and McConnell have done nothing but offer inadequate half-measures that effectively punish state and local governments for the Trump Administration’s inept response to the pandemic.

Third, some Republicans in Washington oppose more federal funding because they claim state and local governments have not spent their CARES funding. Refusing to support more federal funding for Pennsylvania because we used a bipartisan approach and were cautious in spending our CARES funds is both ridiculous and disgraceful.

However, if that argument continues to hold sway and we are being punished for being both bipartisan and prudent, then Pennsylvania needs to spend the remaining funds now so Washington has no excuse for not doing its job.

What did we learn from the first round of CARES funding?

We learned a lot.

First, the financial pain people are suffering was crystallized. We see this from the sheer volume of requests received in programs created with CARES dollars:

- $225 million small/historically disadvantaged business program received over $850 million in funding requests;

- $50 million essential worker hazard pay program received over $900 million in requests;

- $25 million cultural and museum grant program received over $50 million in requests.

Second, more pain is on the horizon. Thousands of Pennsylvanians currently protected by moratoriums on evictions, foreclosures, and utility shutoffs due to loss of work face dire consequences when the moratoriums are lifted if there is no safety net in place.

Third, Act 2A and Act 24 left out many in need. Our small, historically disadvantaged businesses and the restaurant, tavern and hospitality industry have been devastated. Barbers, hair salons, personal care businesses, nonprofits and arts and culture organizations have closed or are on the verge of shutting their doors for good. Childcare providers and our emergency medical services community are suffering. The list is large; the need is great.

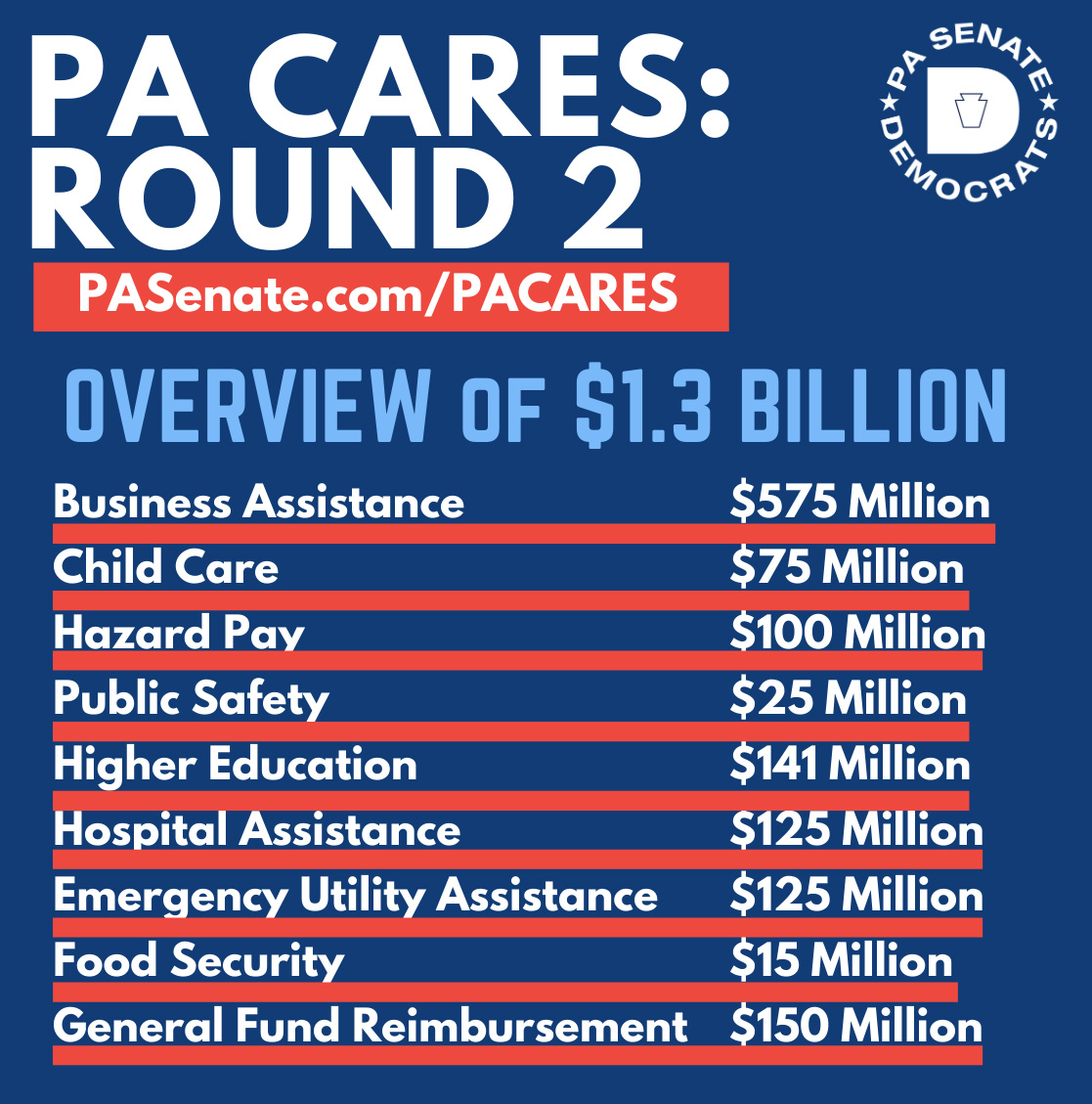

How much does your proposal spend? What areas do you focus on?

Our proposal allocates approximately $1.3 billion from the Coronavirus Relief Fund in the following areas:

Business Assistance $575 million

Child Care $75 million

Food Security $15 million

General Fund Reimbursement $150 million

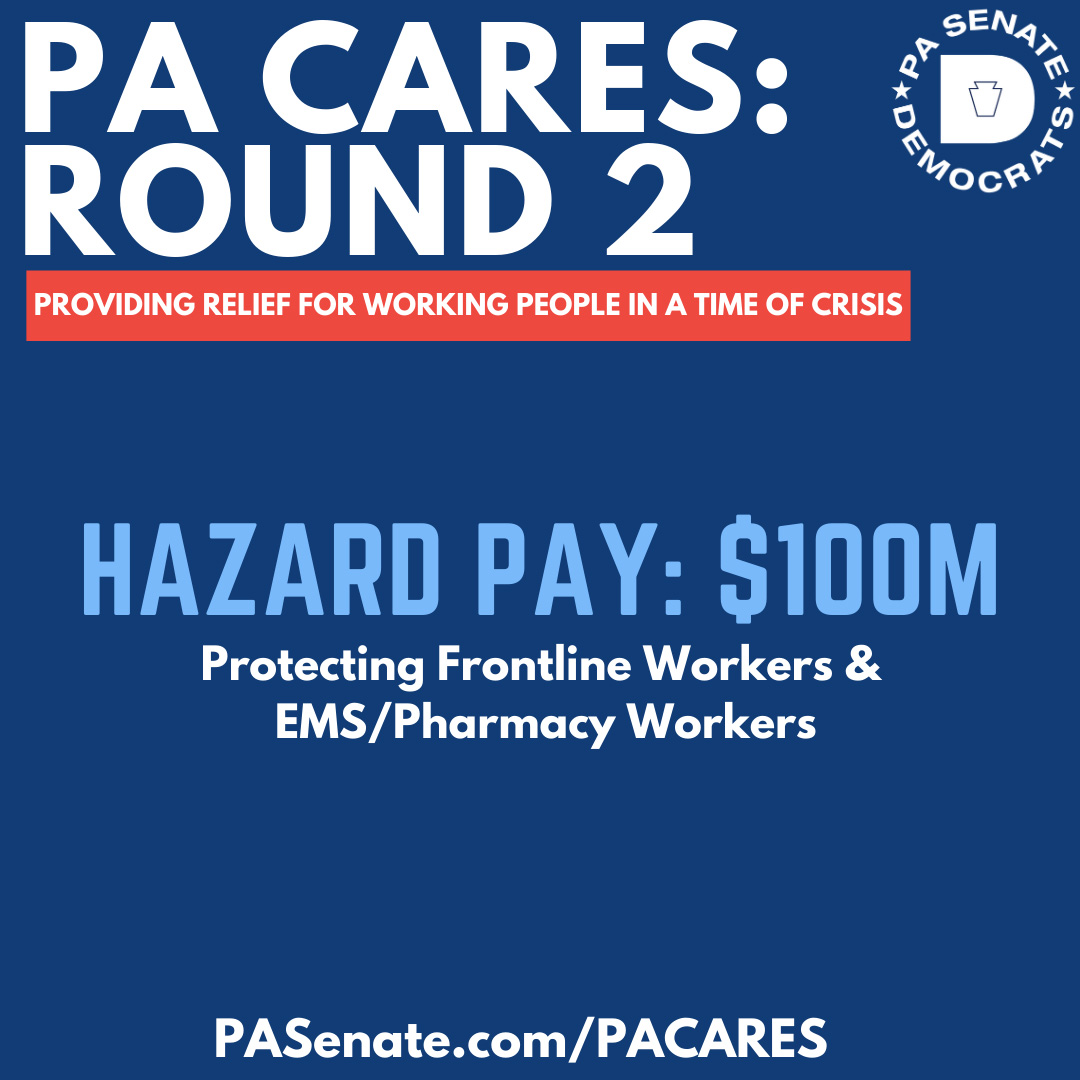

Hazard Pay $100 million

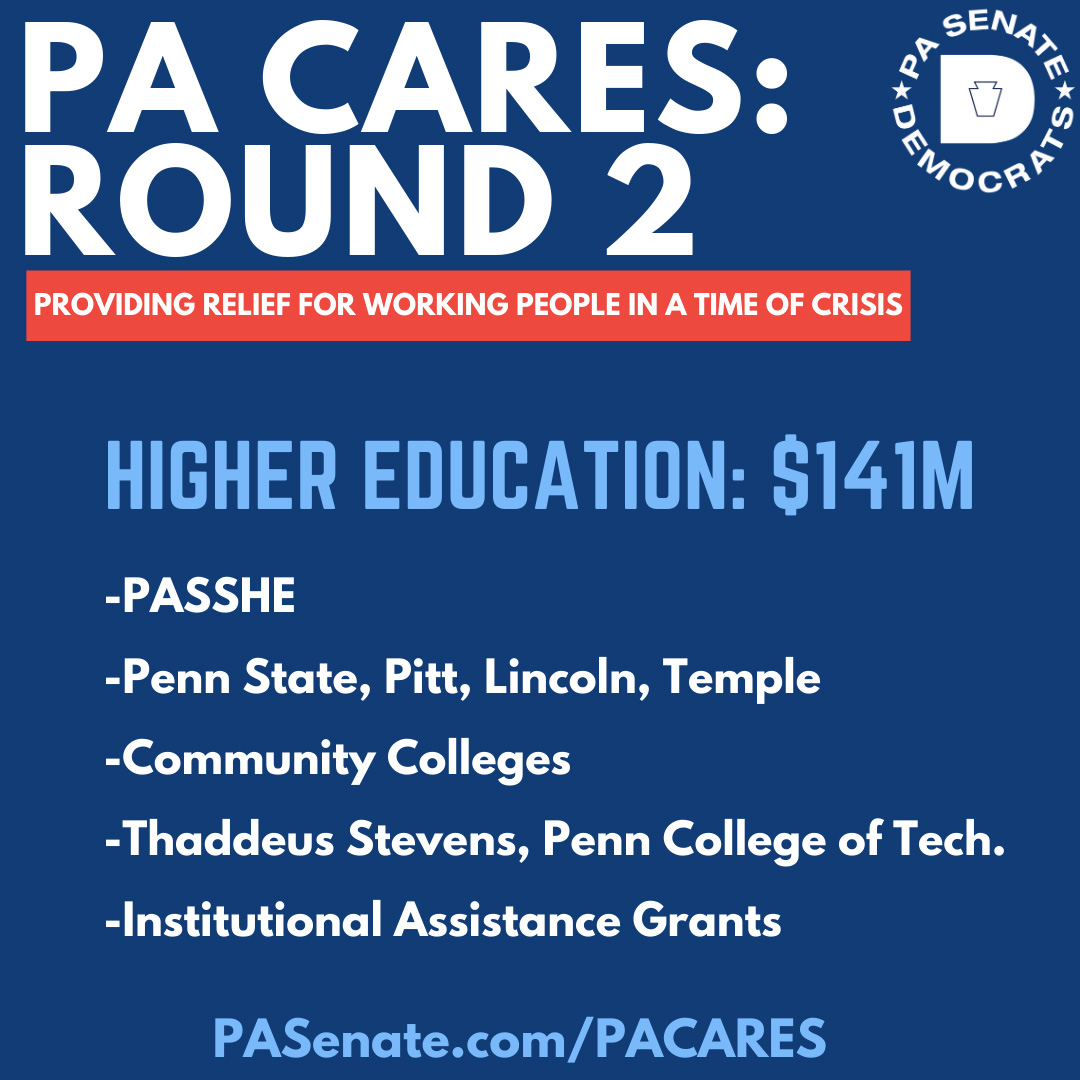

Higher Education $141 million

Hospital Assistance $125 million

Public Safety $25 million

Utility Assistance $125 million

How did you determine priorities for funding?

Pennsylvanians continue to bear the brunt of the pandemic. In Round 1 we focused on getting money into people’s pockets, protecting our health care system and frontline workers, ensuring the viability of our education system, and assisting our small businesses. We continue that commitment in Round 2 while expanding to areas that have shown a real need for assistance.

What is included under each of your categories?

Business Assistance: Targeted funding for bars/restaurants/hospitality industry; additional funding for the current DCED/CDFI program for Main St. and Historically Disadvantaged Businesses; targeted funding for barbers/salons/personal care businesses, nonprofit organizations, and tourism/arts and culture organizations.

Child Care: Additional funding for child-care providers to continue operating.

Food Security: Additional funding for food banks and anti-hunger programs.

General Fund Reimbursements: Funding for Covid-19-related costs to free up General Fund dollars, which will be used to replace lost gaming revenues used for school district property tax relief

Hazard Pay: Additional funding for hazard pay for frontline workers

Higher Education: Funding for higher education institutions for COVID-related expenses

Hospital Assistance: Funding for hospitals that serve our Medicaid population.

Public Safety: Additional funding for EMS and Volunteer Fire Companies that have been impacted by the pandemic.

Will you use existing programs or create new programs to drive out the funds?

For the most part, this proposal utilizes the programs created under Act 24 to drive out the funds. If proposed funding does not fit into an existing program (e.g., utility assistance), a new program will be created.

Additionally, we support fixing programs created by Act 24 (e.g., PHFA’s rental assistance program) as requested by stakeholders to maximize program effectiveness.

What form will the financial assistance take?

Like Round 1, the funds will be allocated as grants to entities that are providing the goods and services we need. Funds will not need to be repaid.

Is this remaining $1.3 billion enough to keep Pennsylvania and Pennsylvanians afloat?

No. This money is not nearly enough. It will help some people only temporarily, and it most cases not fully. It is insufficient to address big issues like K-12 education and local government financial struggles. We need more help from the federal government. State and local governments cannot respond to the pandemic and the needs of our citizens on our own. The financial challenges are too large and state and local resources too limited.

Do you believe federal stimulus talks are dead?

We don’t know but we can’t wait any longer for them to act. If another round of stimulus funding comes at some point in the future, we will address it.

Have you discussed these priorities with the Wolf Administration or the other caucuses?

We’ve had preliminary conversations at the senior staff level about allocating the remaining funds. Some bills have moved out of the Senate Appropriations Committee. Conversations are ongoing.

We don’t consider this a partisan issue. The Senate, the House, and the Governor must come together like we did in May and again produce results for the people of Pennsylvania. Time is of the essence.

Round 1 • April 29

The Pennsylvania CARES Plan offers a set of spending priorities to best use the $3.9 billion in federal CARES ACT funding the commonwealth is set to receive. A major focus of the PA CARES Plan is funding initiatives that help individuals and families, such as housing assistance programs, student debt relief, veterans’ assistance, utility assistance, and food bank support.

Other aspects of the proposal include allocating additional assistance to frontline workers, funding for the health care industry and its workers, small business grants, and much-needed support communities disparately impacted by the COVID-19 pandemic. School districts and local governments would also receive support to help offset pandemic-related expenses.

The Senate Democrats’ response to the COVID-19 pandemic remains focused on helping working people, families and Pennsylvania’s small businesses. Members of the caucus have a number of proposals to address COVID-19 relief and recovery efforts in Pennsylvania.

Highlights

Frequently Asked Questions

What are we announcing?

What are the restrictions on the use of CARES Act Fund?

Can Coronavirus Relief Fund dollars be used to close the looming budget deficit?

How much does your proposal spend? What areas do you focus on?

Our proposal allocates approximately $3.9 billion from the Coronavirus Relief Fund over the following 10 areas:

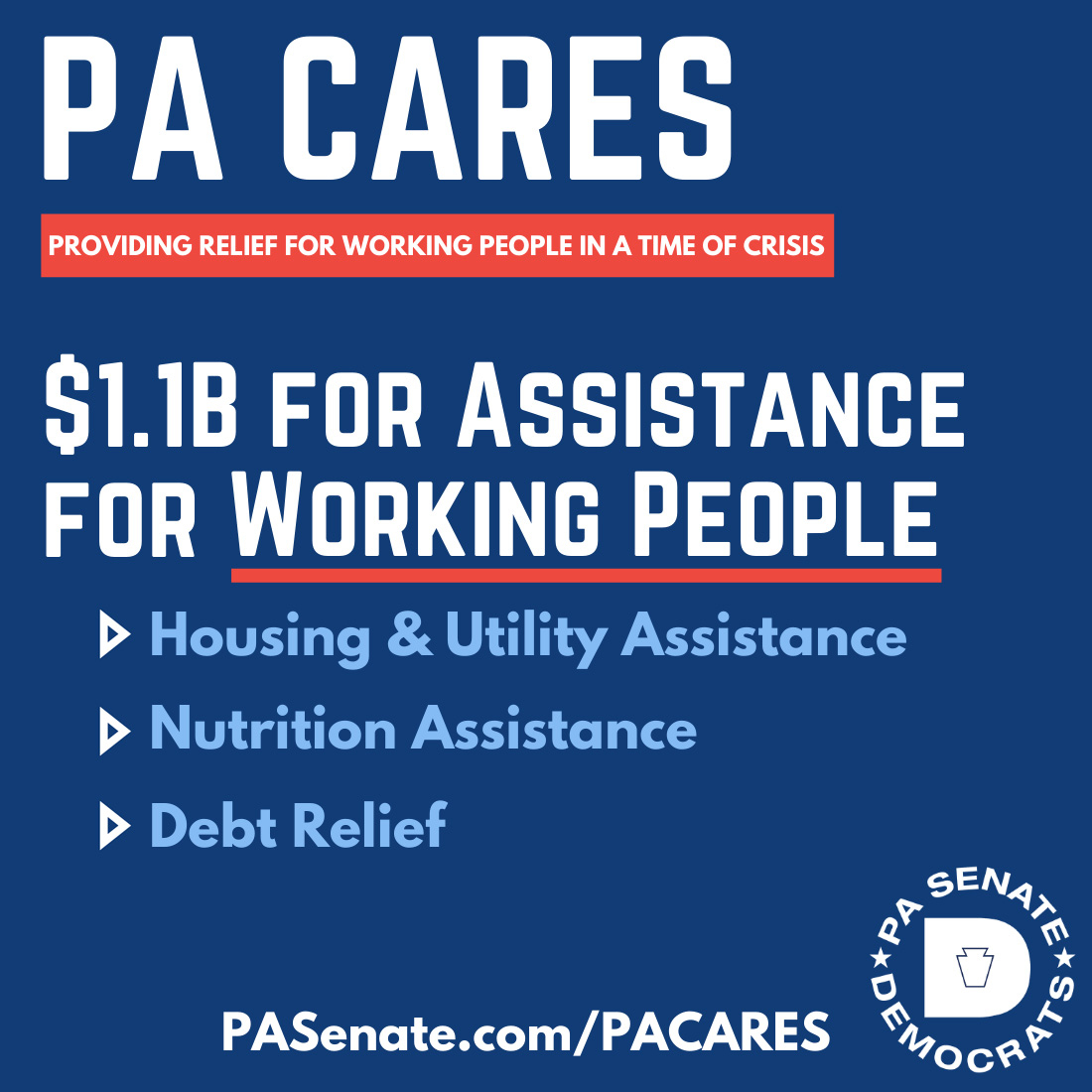

Individuals/Families $1.1 billion

School Districts/Local Government $750 million

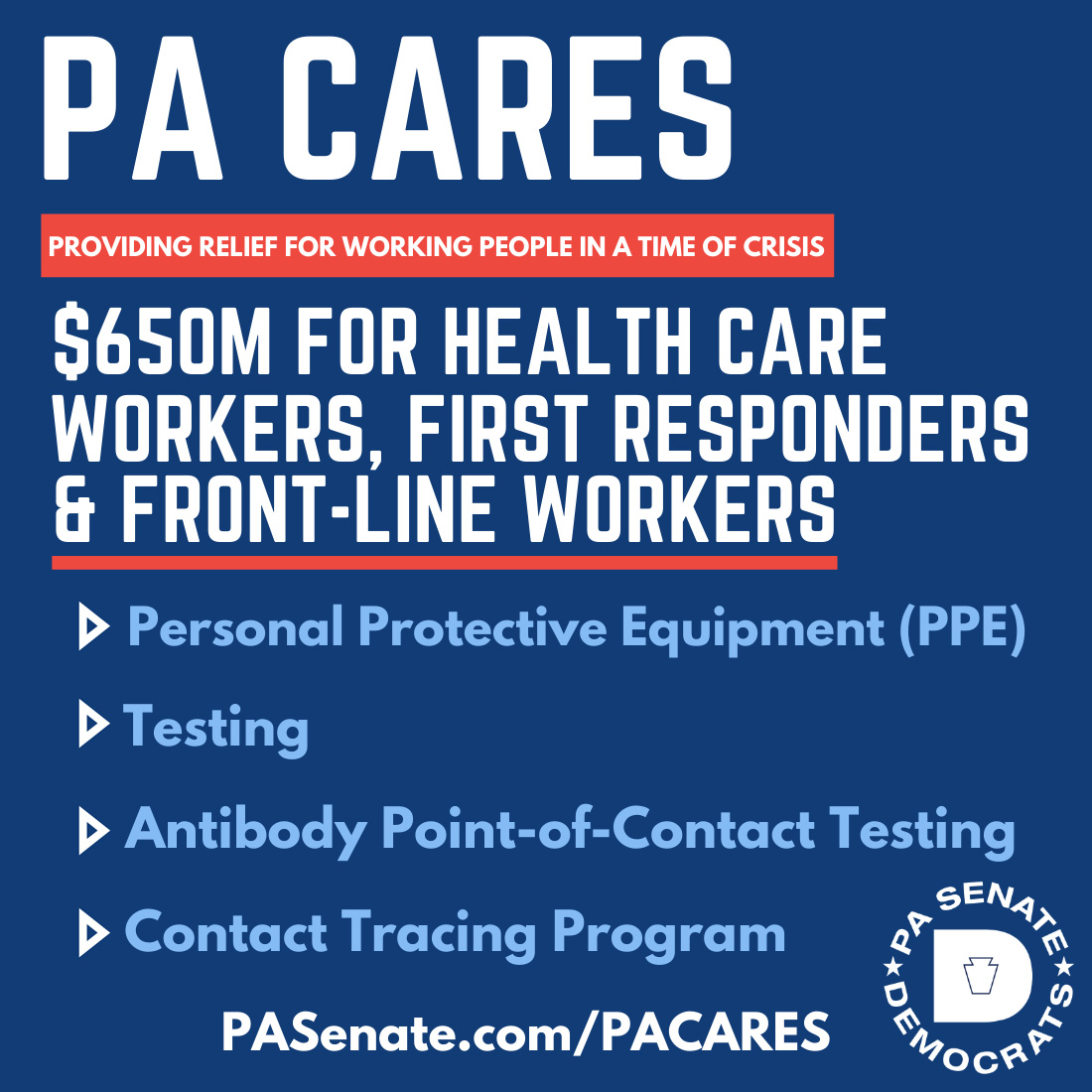

Health Care, First Responder & Frontline Workers $650 million

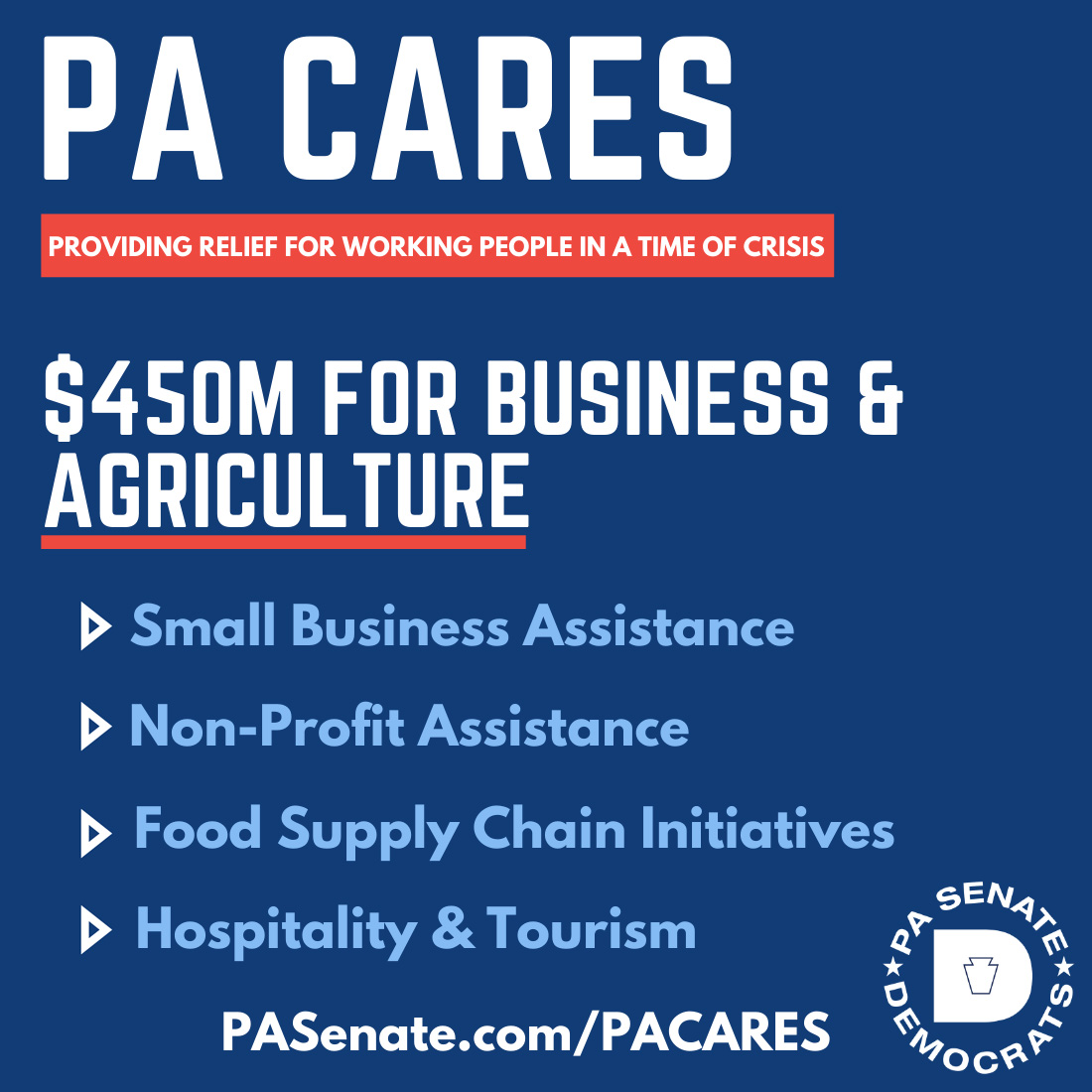

Small Business $425 million

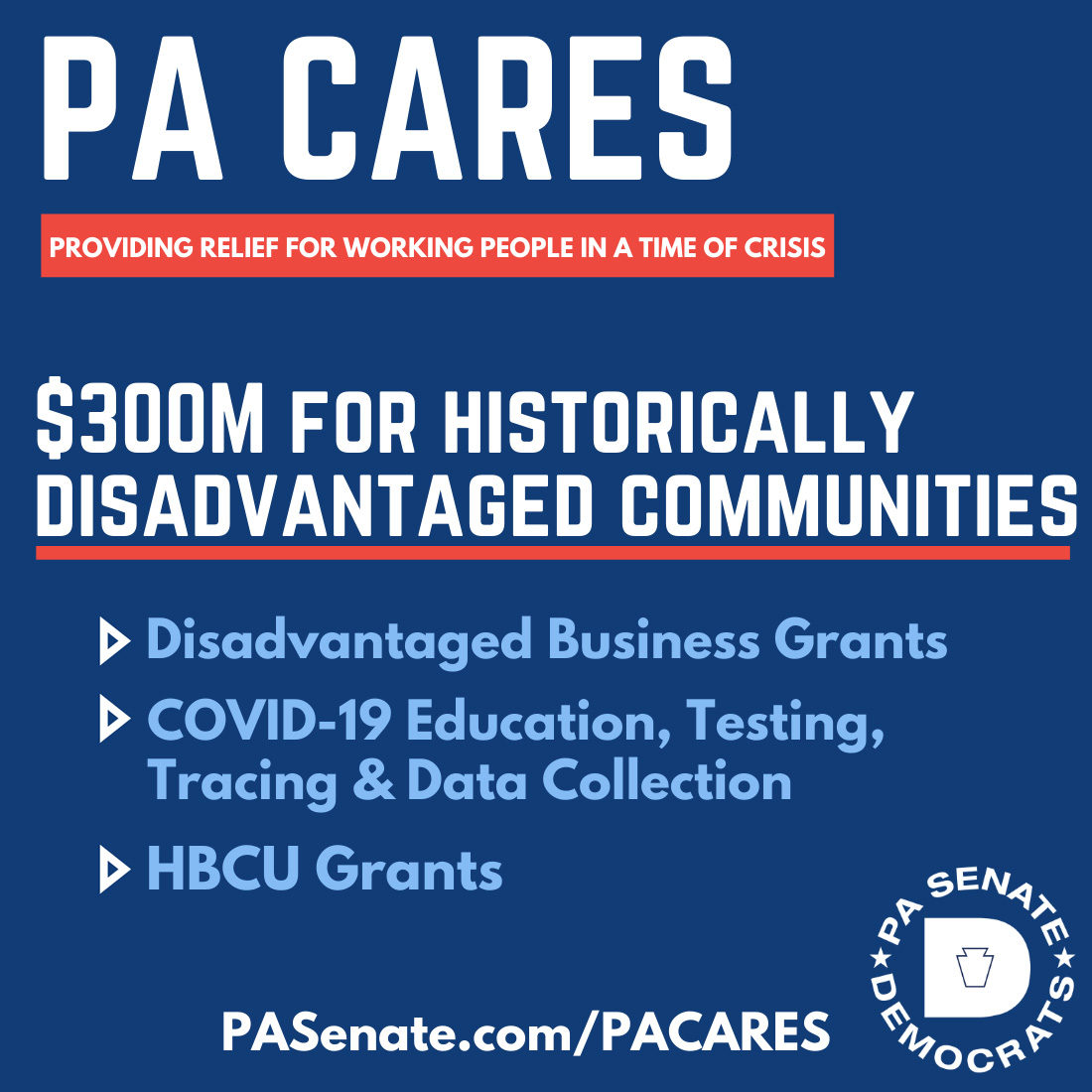

Historically Disadvantaged Communities $300 million

Higher Education $250 million

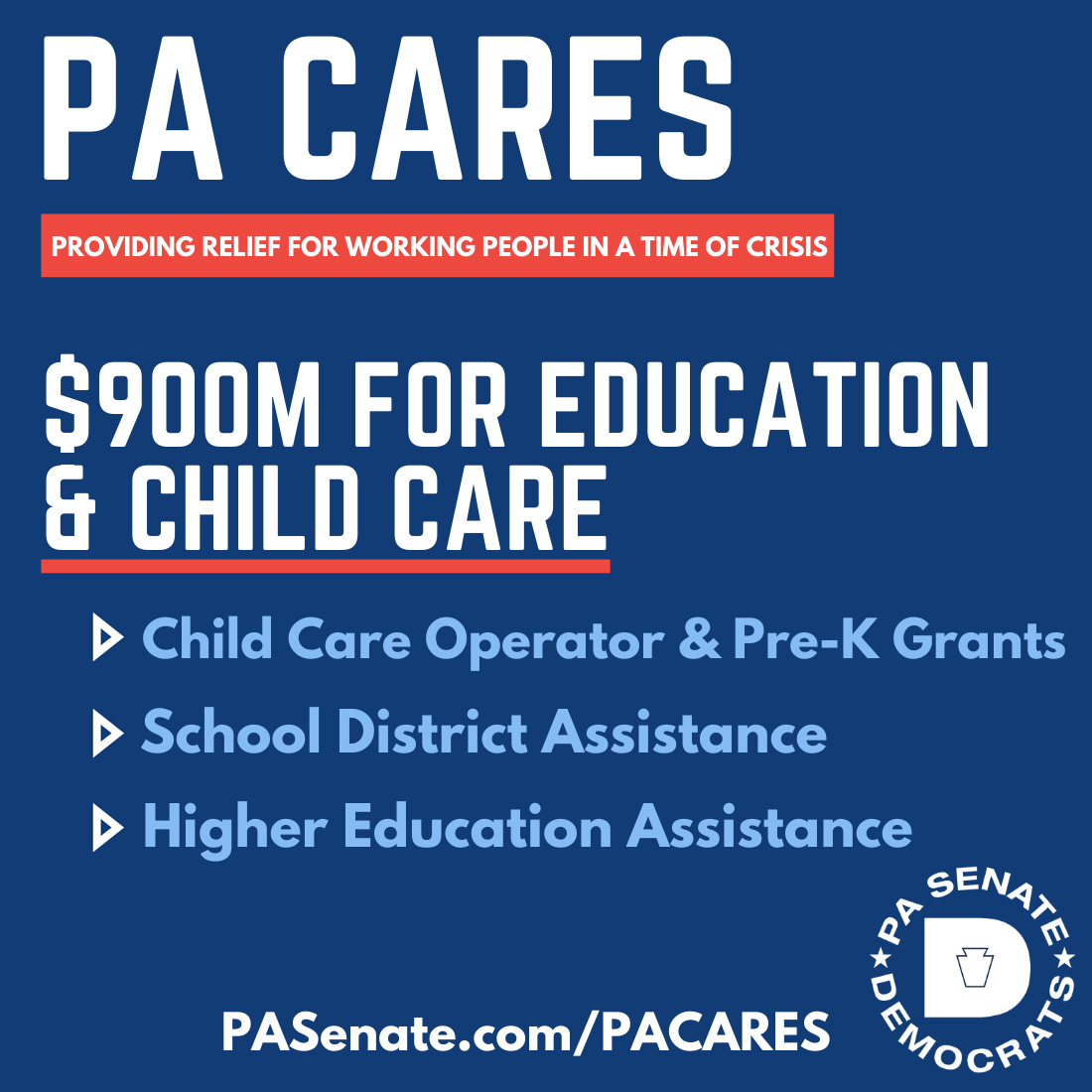

Child Care/Early Education $150 million

State Government Infrastructure $100 million

Agriculture $25 million

Election Security $25 million

The proposal also allocates $100 million from education-related funds for K-12 schools for expenses related to shifting to distance learning, including costs of equipment.

How did you determine priorities for funding?

What form will the financial assistance take?

Have other federal funds been allocated in the areas you have prioritized?

What is included under each of your 10 categories?

Individuals/Families: Funding for housing assistance (including, homelessness, domestic violence, mortgage assistance, landlords, and legal services), student debt assistance, utility bill assistance, veterans assistance, and food banks

School Districts/Local Government: Funding for school district costs, including special education, and county and municipal government costs related to COVID-19.

Health Care: Funding for our safety net, including high Medicaid hospitals, Long-term Care facilities, and Community Health Centers. Funding is also provided for comprehensive testing, tracing and tracking of COVID-19 and for our frontline workers, including hazard pay, post-traumatic stress treatment. First responders also receive funding.

Small Business: Grants to small business, nonprofits and specific sectors of the small business economy that have been hit particularly hard by the COVID-19 pandemic.

Historically Disadvantaged Communities: Black and brown communities are being ravaged by COVID-19. Education, testing and tracing are need in these communities. In addition, businesses in these communities have been largely unsuccessful in securing federal small business funds. Funding to address nutrition and access to fresh foods and vegetables will be provided along with emergency funding for the commonwealth’s two (2) Historically Black Colleges and Universities

Child Care/Early Education: Our child-care and Pre-K operators are struggling to maintain operations. These stresses will only increase as the economy starts to gradually re-open and parents go back to work.

State Government Infrastructure: Clearly there have been some issues with agency responses to COVID-19. We need to upgrade our infrastructure to address COVID-19 and future events that may strain our systems.

Agriculture: Grants to ensure that our food supply chain can continue to function.

Election Security: Funding to ensure that the June 2 primary election and the November general election are conducted in a safe and secure manner.

Have you discussed these priorities with the Wolf Administration or the other caucuses?

Yea, what about the FY 20-21 budget?

Good question. Appropriations Committee staffs and the Budget Office have had preliminary discussions. No decisions have been made or timelines for action set. Certainly, a lot will depend on revenue collections. As mentioned, The Trump Administration for the most part has prohibited Coronavirus Relief Funds from being used to replace state and local tax revenues.

Even if Coronavirus Relief Funds could be used to fill our budget hole, or if another round of federal stimulus funding for state and local governments comes from Washington D.C., these are one-time funds. The IFO has projected that the permanent revenue loss in tax revenue for the commonwealth to be approximately $2.7 billion for FY 20-21 and 21-22. We need to be careful of using one-time revenues to plug recurring revenue holes. We also should not repeat the mistakes of the past by relying on massive budget cuts to fix our problems. That was the route taken coming out of the Great Recession in 2011 and the impacts were devastating on the commonwealth and its residents.

Our Members at Work

Senate Democrats Offer Restaurant & Tavern Recovery Legislation

Harrisburg, Pa. – June 21, 2021 − After Republicans failed to pass a clean, bipartisan bill to extend mixed drinks to go for restaurants and taverns, the Pennsylvania Senate Democrats are introducing legislation that will provide the opportunity for bars, taverns and...

Sen. Brewster Applauds Passage of State-wide COVID-19 Relief Package

HARRISBURG, February 5, 2021 State Sen. Jim Brewster released the following statement on today’s passage of Senate Bill 109, a sweeping COVID relief package that, along with federal action, contains measures the former banker-turned-state Senator proposed more than...

Sen. Hughes Touts Passage of Critical COVID-19 Relief Legislation that Includes Key Rental Assistance, Small Business Grant Provisions

PHILADELPHIA — February 5, 2021 — State Senator Vincent Hughes (D-Philadelphia/Montgomery) touted the Pennsylvania General Assembly’s action to drive out COVID-19 relief for vulnerable residents Friday after Senate Bill 109 was sent to Gov. Tom Wolf for signature. The...

Sen. Hughes issues statement following Gov. Wolf initiating $145M transfer of funds to support PA small businesses

PHILADELPHIA – December 23, 2020 – State Senator Vincent Hughes (D-Philadelphia/Montgomery) issued the following statement after Gov. Tom Wolf announced a transfer of $145 million from the commonwealth’s Workers’ Compensation Fund Security Fund at the...

Senator Tartaglione Applauds Wolf’s Proposal to Make $145 Million Available for Small Business Relief

Philadelphia, PA – State Senator Christine Tartaglione (D-Philadelphia) applauded today’s announcement by Governor Tom Wolf of his intent to transfer $145 million from the state’s Workers’ Compensation Security Fund into the General Fund so that they may be reallocated for pandemic-related small business relief. Senator Tartaglione also urged her General Assembly colleagues to grant the legislative authorization required to appropriate the funds as grants to small businesses adversely affected by the pandemic.

Tartaglione, PA Senate Democrats Unveil $4 Billion COVID-19 Relief and Recovery Plan

PA CARES 21 would assist families, workers, businesses, healthcare providers, educational institutions, first responders, local governments, and other entities that have been devastated financially by the pandemic. Philadelphia, PA – December 4, 2020 − State...

Comitta, State Senators Call for State Pandemic Relief Plan

PA CARES 21 Allocates $300 Million for Restaurants and Bars WEST CHESTER (December 4, 2020) – State Senator-Elect Carolyn Comitta joined more than a dozen state senators in announcing a $4 billion pandemic relief plan to provide direct aid to workers, families, small...

Pa Senate Dems Unveil Innovative $4 Billion Pandemic Relief Plan to Help Front-Line Workers, Vulnerable Residents, Small Businesses and More

Pennsylvania − December 4, 2020 − Aiming to stimulate Pennsylvania’s economy by providing direct aid to workers, families, small businesses and other vulnerable populations, the Pennsylvania Senate Democratic Caucus announced a bold, innovative $4 billion pandemic...

Senators Costa & Hughes Slam Republican Inaction on Federal CARES Funds

HARRISBURG – October 29, 2020 – Senate Democratic Leader Jay Costa and Senate Democratic Appropriations Chair Senator Vincent Hughes and members of the Pennsylvania Senate Democratic Caucus today slammed House and Senate Republicans for recessing the General Assembly until mid-November without passing legislation to drive out Pennsylvania’s remaining $1.3 billion in federal CARES funds to Pennsylvanians suffering the economic impacts of the coronavirus pandemic.

Senator Costa Announces More Than $1 Million in Funding for COVID Related Needs in Local Schools

Pittsburgh, Pa. − October 27, 2020 − Senate Democratic Leader Jay Costa, Jr. today announced the award of $1,152,408 in funding for local school districts to deal with COVID-related needs. The following schools in the 43rd Senatorial District will receive funds: Penn...

PA Senate Democrats Unveil Plan to Spend $1.3 Billion in Remaining Cares Funds

Harrisburg − October 16, 2020 − Members of the Pennsylvania Senate Democratic Caucus today outlined a plan to spend the remaining $1.331 billion in CARES money that Pennsylvania received as part of a federal assistance package earlier this year.

Senator Costa Announces $1.6 Million In Cultural Grants For The Region

Pittsburgh, PA - September 15, 2020 − Senate Democratic Leader Jay Costa, Jr. today announced the award of $1,654,233 in cultural grants for the 43rd senatorial district. Today’s grants are funded by money allocated to the state in the CARES Act, a federal recovery...

Senate Committee Unanimously Advances Tartaglione-Costa Legislation to Fund PA Higher Education Institutions

Philadelphia, PA – September 9, 2020 − The Pennsylvania Senate Appropriations Committee today advanced legislation sponsored by State Senator Christine Tartaglione and Senate Democratic Leader Jay Costa that would allocate $130 million in federal CARES Act funding to help higher education institutions in the Commonwealth manage financial hardships caused by the COVID-19 pandemic.

Sen. Muth Supports Ensuring Mortgage Servicers’ Compliance with Federal Cares Act to Protect Homeowners

Royersford, PA, September 3, 2020 – Sen. Katie Muth (D-Berks, Chester, Montgomery) Minority Chair of Housing and Urban Affairs, and the members of the Senate Democratic Caucus sent a letter to the Pennsylvania Department of Banking and Securities, fully...

Sen. Hughes touts $50 million in hazard pay grants awarded to PA’s front-line businesses

PHILADELPHIA – August. 17, 2020 — State Senator Vincent Hughes (D-Philadelphia/Montgomery) announced that $50 million in hazard pay grants had been recently awarded to Pennsylvania businesses through the Department of Community and Economic Development...

Senators Jim Brewster & Pam Iovino Propose $100 Million COVID-19 Grant Program & Financial Relief Package for PA Restaurants & Taverns

Allegheny County, PA – July 23, 2020 – Today, State Senators Jim Brewster and Pam Iovino announced a comprehensive proposal to provide emergency relief to Pennsylvania’s restaurants and taverns, which have seen significant financial loss due to the COVID-19 pandemic and resulting shutdown. The seven-point plan includes a $100 million grant program to retail liquor licensees using federal CARES Act funds, as well as a suite of policy changes to financially benefit these struggling businesses.

Sens. Hughes, Haywood join PHFA to announce upcoming financial assistance program for renters and homeowners hurt by the COVID-19 pandemic

PHILADELPHIA— July 1, 2020 — State Senators Vincent Hughes (D-Philadelphia/Montgomery), Art Haywood (D-Montgomery/Philadelphia) and Director Robin Wiessmann from the Pennsylvania Housing Finance Agency (PHFA) announced a new program that will help renters and...

Senator Haywood, Hughes, Street announce $175 million housing assistance program

PA Senate Democrats Announce $225 Million for Small Business Assistance Grants Statewide

HARRISBURG – June 8, 2020 – Members of the Pennsylvania Senate Democratic Caucus announced the direction of $225 million in federal CARES Act funding to aid small businesses across the commonwealth. This funding was authorized by the recently enacted COVID-19...

Democratic PHEAA Board Members Tout $30 Million In Cares Act Funding For PHEAA Grants

HARRISBURG — June 5, 2020 — State Senators Wayne Fontana (D-Allegheny), Vincent Hughes (D-Philadelphia/Montgomery), John Blake (D-Lackawanna), and Art Haywood (D-Montgomery/Philadelphia touted the $30 million in funding the Pennsylvania Senate Democratic Caucus was...

Senator Haywood Announces the Approval of Housing Relief Funds to Prevent Foreclosure and Eviction

Harrisburg – May 29, 2020 – State Senator Art Haywood (D-Philadelphia/Montgomery) announced that the Pennsylvania House and Senate passed his housing relief plan with $193 million on May 28. The Governor has agreed to sign this legislation. “I am happy to...

Senators Street & Haywood Secure $175 M Housing Relief Package in PA Budget

Philadelphia PA – May 29, 2020 – On Thursday, Senator Sharif Street (D-Philadelphia) and Senator Art Haywood (D-Montgomery/Philadelphia) successfully secured $175 million in rental and mortgage assistance, a measure included in the temporary 5 month budget featuring...

Senator Pam Iovino’s Statement of Support for Pennsylvania’s Interim Budget

Allegheny County, PA – May 28, 2020 – Pennsylvania State Senator Pam Iovino (D – Allegheny & Washington), released the following statement today after voting to support the passage of a $26 billion interim budget for the Commonwealth of Pennsylvania, including...

Sen. Anthony Williams Announces PA Senate Allocation of $2.6 Billion CARES Act Relief Funds

Harrisburg – May 28, 2020 – Sen. Anthony Williams (D- Philadelphia/Delaware) announced that the Pennsylvania Senate has passed Senate Bill 1108 which allocates $2.602 billion of federal CARES Act for Pennsylvania. “These funds were given to Pennsylvania through the...

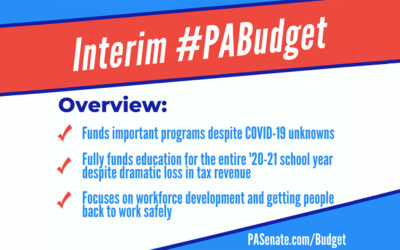

Senator Costa Supports 5-Month State Budget, Fully Funding Education and Spending State’s Federal Cares Money

Harrisburg, Pa. − May 28, 2020 – Senate Democratic Leader Jay Costa, Jr. today voted in support of House Bill 2387, a General Appropriations bill that funds state operations through November, and fully funding education through the entire fiscal year. The bill passed...

Sen. Blake Statement on Passage of $25.789 Billion Interim State Budget and CARES Funding

SCRANTON, May 28, 2020 – State Sen. John Blake (D-Lackawanna/Luzerne/Monroe) today released the following statement regarding passage of a $25.789 billion interim state budget that accounts for five months of spending for most appropriations. The interim budget fully...

PA Senate Democrats Announce $550 Million Main Street Business Revitalization Grant Program

Harrisburg, PA − May 22, 2020 − Senators Jay Costa, Vince Hughes, John Blake, Jim Brewster and Pam Iovino today called for $550 million of funds allocated to Pennsylvania through the federal CARES act to be used for a program they are calling the Main Street Business...

PA State Senate Unanimously Passes Legislation to Provide $538 Million in CARES Act Funding for Nursing & Long-Term Care Facilities and Fire & EMS Grants

Legislation Includes Senators Iovino & Kearney Amendment to Allow Volunteer Firefighter Relief Association Funds to be Used for COVID-19 Expenses Harrisburg, PA – May 13, 2020 – Yesterday evening, the Pennsylvania State Senate unanimously passed Senate Bill 1122,...

Sens. Costa, Hughes unveil PA CARES, a plan to allocate federal CARES Act funds

HARRISBURG – APRIL 29, 2020 – State Senators Jay Costa (D-Allegheny) and Vincent Hughes (D-Philadelphia/Montgomery) unveiled the Pennsylvania Senate Democratic Caucus’ plan to allocate federal Coronavirus Aid, Relief, and Economic Security (CARES) Act funds Wednesday...

Our Supporters

- Christin B (Pittsburgh)

- Linda R (Uniontown)

- Julia B (Cochranton)

- Stacey M (Philadelphia)

- Crystal C (Philadelphia)

- Angel a (Mount Washington)

- Brian C (Philadelphia)

- Jacqueline L (Philadelphia)

- Brad W (Exton)

- scott w (Malvern)

- Rich S (Mifflinburg)

- Brian F (Mechanicsburg)

- Donna K (Brownsville)

- Donald R (Narvon)

- David D (Jim Thorpe)

- Melissa W (Monongahela)

- Samantha K (McKeesport)

- Jacqueline L (Philadelphia)

- Karen B (Jim Thorpe)

- Michael G

- Eileen N (Marietta)

- Matthew G (Upper Darby)

- Staci B (Harrisburg)

- Ross W (Holland)

- Michael D (Mechanicsburg)

- Michelle M (Philadelphia)

- William L (Northampton)

- Jessica B (Enon Valley)

- Donald D (Hollidaysburg)

- Russell F (Reading)

- Dana S (Pittsburgh)

- Ronald T (Phila)

- Sue M (Hamburg)

- Heather N (Pittsburgh)

- Kedah F (Philadelphia)

- Shyra S (Chambersburg)

- Erin P (Kingston)

- Jade J (Dillsburg)

- Charles S (Shillington)

- Ryan P (Mertztown)

- Mikele E (Philadelphia)

- Matthew M (Lansford)

- Brandy M (Cochranton)

- Jennifer H (Bellefonte)

- Karen S (Forty Fort)

- Deon M (Erie)

- Christopher M (Rostraver Township)

- Jack r (Homer City)

- Troy T (Shermans Dale)

- Katie C (Wilkes-Barre)

- Jennifer H (Bellefonte)

- Mikele E (Philadelphia)

- Dennis W (Chester)

- Nancy A (New Kensington)

- Millasia C (Philadelphia)

- Yilliam B (Philadelphia)

- Lauren G (Erie)

- Brody B (Monroeville)

- KEndra H (Greentown)

- Nikki M (Dauphin)

- Zoe B (Pittsburgh)

- Constance F (Tamaqua)

- Jenna T (Hellertown)

- Dawn S (Lebanon)

- Christopher M (Rostraver Township)

- Bertina P (Phoenixville)

- Lisa S (Plymouth)

- Courtney K (Stroudsburg)

- Yolie C (Wellsboro)

- Jodi M (Pittsburgh)

- Cindy L (Philadelphia)

- Ameera T (Philadelphia)

- Caleb G (Natrona Heights)

- Lena L (Pittsburgh)

- Emery A (Belle Vernon)

- Oneil M (West Newton)

- Brittany C (Carlisle)

- Leisa C (Harrisburg)

- Jason S (Palmyra)

- James R (Carlisle)

- Shannon S (Harrisburg)

- Matthew C (Mechanicsburg)

- Emily W (Harrisburg)

- James D (Newtown Square)

- Pinar Y (Harrisburg)

- Malika M (Glendide)

- Dean O (Lancaster)

- Ashley J (Philadelphia)

- Michael R (Harrisburg)

- Ellen T (Dresher)

- Jane G (Perkiomenville)

- Desiree H (Washington)

- Laura B (Philadelphia)

- Nicole H (Philadelphia)

- Bob P (Norwood)

- Andrew H (Garnet Valley)

- Haylee H (Somerset)

- Heather S (Harrisburg)

- Haylee H (Somerset)

- Michael P (Lancaster)

- Joseph D (Glenolden)

- Rose D (Philadelphia)

- Kathryn N (Bethel Park)

- JOHN M (Catasauqua)

- Bobbijo L (Sunbury)

- Rosalind H (Elkins Park)

- Brittney F (Upper Darby)

- Emery A (Belle Vernon)

- Christopher M (Rostraver Township)

- Deborah P (Jenkintown)

- Taylor S (Pittsburgh)

- DAVID E (Philadelphia)

- Kevin P (Carnegie)

- Ebony D (York)

- LaToyia T (Roslyn)

- Tammy H (Lake City)